Welcome to the new era of audit efficiency

- 9 minutes read

In a recent CPA.com survey, auditors pointed to new technologies as the key to unlocking higher levels of efficiency. Here's how they're putting this tech to work.

Auditors are always on the hunt for new ways to make the audit more efficient. By their very nature, audits are time-consuming and process-intensive - characteristics that have significant ripple effects throughout the audit firm, regardless of size. The more time auditors spend on laborious, largely repetitive tasks, the less time they have available to spend on more valuable, strategic tasks that require human insight. The effects on audit quality can be equally significant because the more time auditors spend on repetitive tasks such as data entry, the greater the opportunity for errors. For all these reasons and more, the lean, efficient audit is the holy grail for most auditors - and most would agree there is always room for improvement.

Ironically, the processes that make audits so notoriously complex are the source of new optimism regarding the potential for increasing audit efficiency. That's because new technologies have the ability to dramatically improve many of these processes - and they are delivering. These technologies are not unique to accounting; in fact, many of them have been pioneered and tested in other industries, and are now being modified and applied to the accounting profession.

Today, there is a growing interest among auditors in adopting new technologies that help make the audit more efficient, especially given the growing pressure to simultaneously deliver higher quality audits and more strategic guidance to clients while also facing heightened competition and tightening margins.

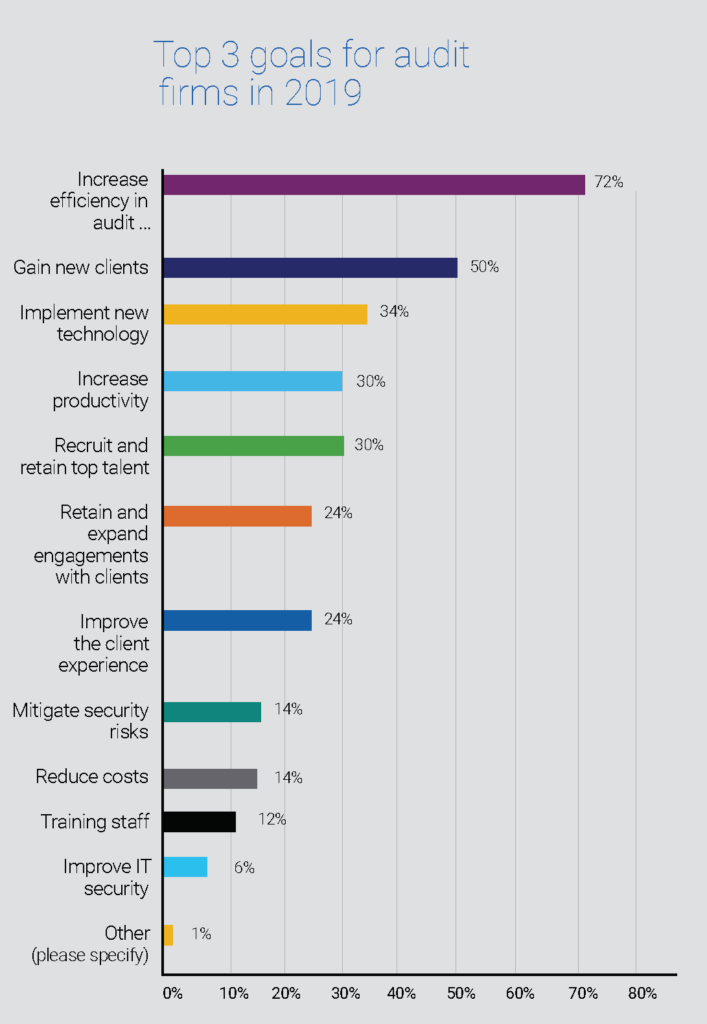

Recent results from a CPA.com survey underscore these points. In this survey of more than 250 auditors at small, medium and large firms, 27% identified "increasing efficiency in audit" as their top goal for 2019. This is 21 percentage points more than the second most-identified goal, "gaining new clients. Their third goal is "implementing new technology" - which makes sense given their aggressive goals for achieving greater levels of efficiency. In fact, when asked to rank the benefits of technology, "enhanced audit efficiency" and "improved audit quality" were identified as the top-two benefits, at 40% and 29% respectively, with "increased profitability" coming in at a distant third place.

With increased audit efficiency being the top goal for auditors in 2019, and with most auditors stating that increased efficiency is a leading benefit of new technology, we wanted to know: How exactly are auditors using technology to achieve new levels of efficiency? Here's what the auditors responding our survey had to say.

Top efficiency opportunity: Audit confirmation

The audit is a complex, multi-stage, process-intensive undertaking, presenting many potential targets for efficiency-focused innovation. So where to start? The audit confirmation process stands out as a prime target for this type of innovation. Audit confirmation is replete with manual, repetitive, time-consuming steps such as testing the completeness of populations, sampling and sending confirmations, comparing confirmations with client-provided information, resending confirmations, and more - many of which could be either replaced or assisted by technology. There are ample signs that this shift is already underway among auditors today.

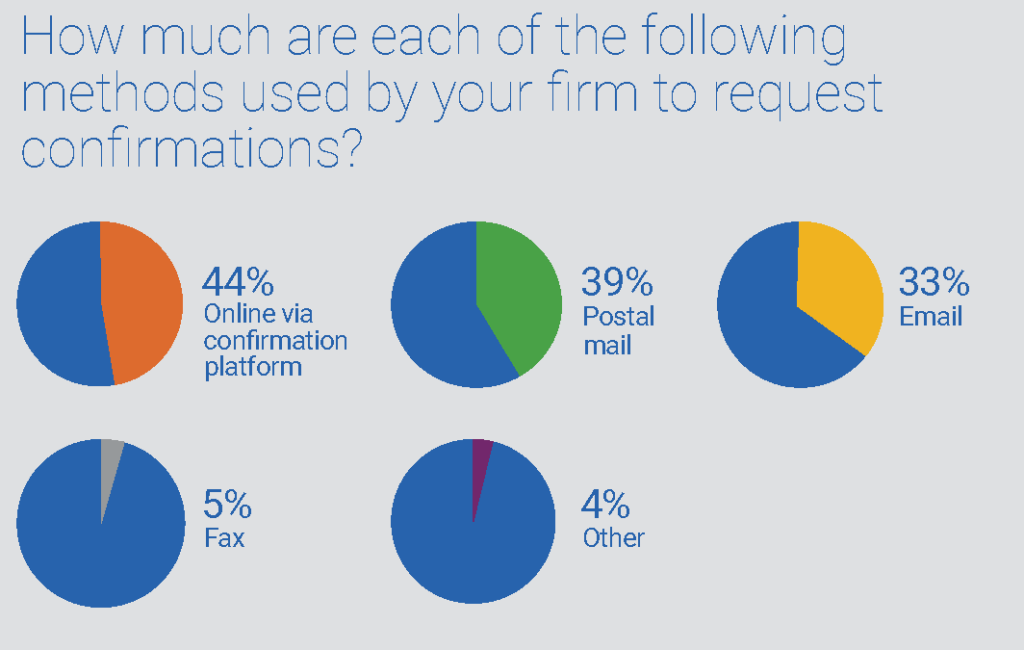

Online management of the confirmation request process is now the top method in use among auditors today, with 44% of survey respondents indicating that they use the Confirmation platform to manage this important component of the audit. Postal mail, meanwhile, is used by 39% of auditors. This is the result of a years-long trend toward greater use of digital platforms - survey respondents who reported using such a platform jumped more than 41% over three years. This has big implications for auditors for a number of reasons, starting with the competitive environment. Auditors who are quick to adopt and deploy digital tools to help streamline the audit will almost certainly hold a significant competitive advantage over those who haven't yet, influencing everything from profitability, quality and reputation to talent recruitment and retention.

Auditors are already seeing the results of this important shift. "When you take away a process that's disjointed and inefficient - like processing paper confirmations that you have to pick up and put down multiple times - that makes a huge difference," says Peter Henley, CPA/CITP, Senior Director at Clark Number P.S.

Just as important, clients can see the difference, too. "We've realized significant administrative savings," says Sam Timothy, president and owner of Timothy, DeVolt and Company, P.C., "and we have received the same feedback from our audit clients."

One step at a time

For audit firms seeking to achieve greater efficiency in the confirmation process through technology, where should they start? The truth is that today's confirmation-focused technology is well-suited to all confirmation types, so this decision is largely a function of the unique variables in play at each individual firm.

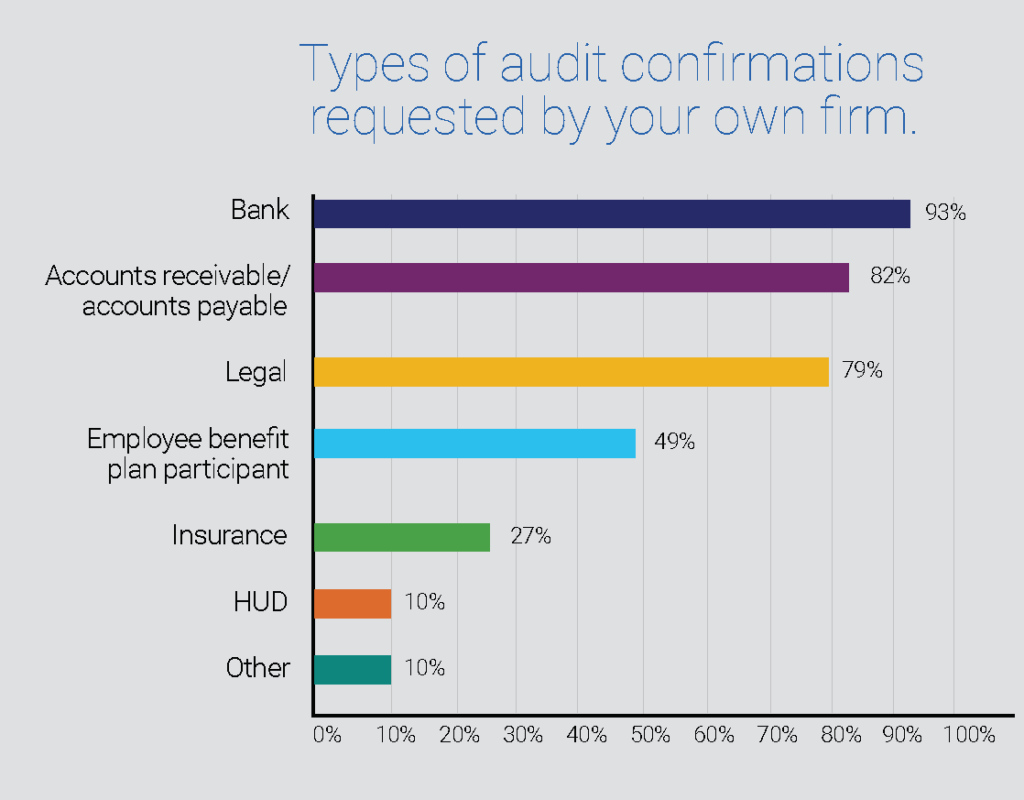

When it comes to determining where to start, it is clear that most auditors have choices. Survey respondents reported that they are responsible for a range of confirmation types, including bank, legal, insurance, HUD, AR/AP, and employee benefit plans, all of which figure heavily in the process for most auditors. This range presents an opportunity for auditors, who can test their approach with one type of confirmation, then move on to others as their processes mature and they find successes that can be replicated elsewhere.

Many auditors choose to begin with bank confirmations, which loom large over the audit confirmation process. 93% of auditors report that they request audit confirmations from banks. While different types of confirmations present their nuances, the activities required are generally similar. Which means that wherever auditors start, their findings and best practices can be easily extended. Plus, auditors who use a standard, commercially available digital platform are able to benefit from industry-level best practices built into the platform itself, informed by the experiences of others who have used it extensively.

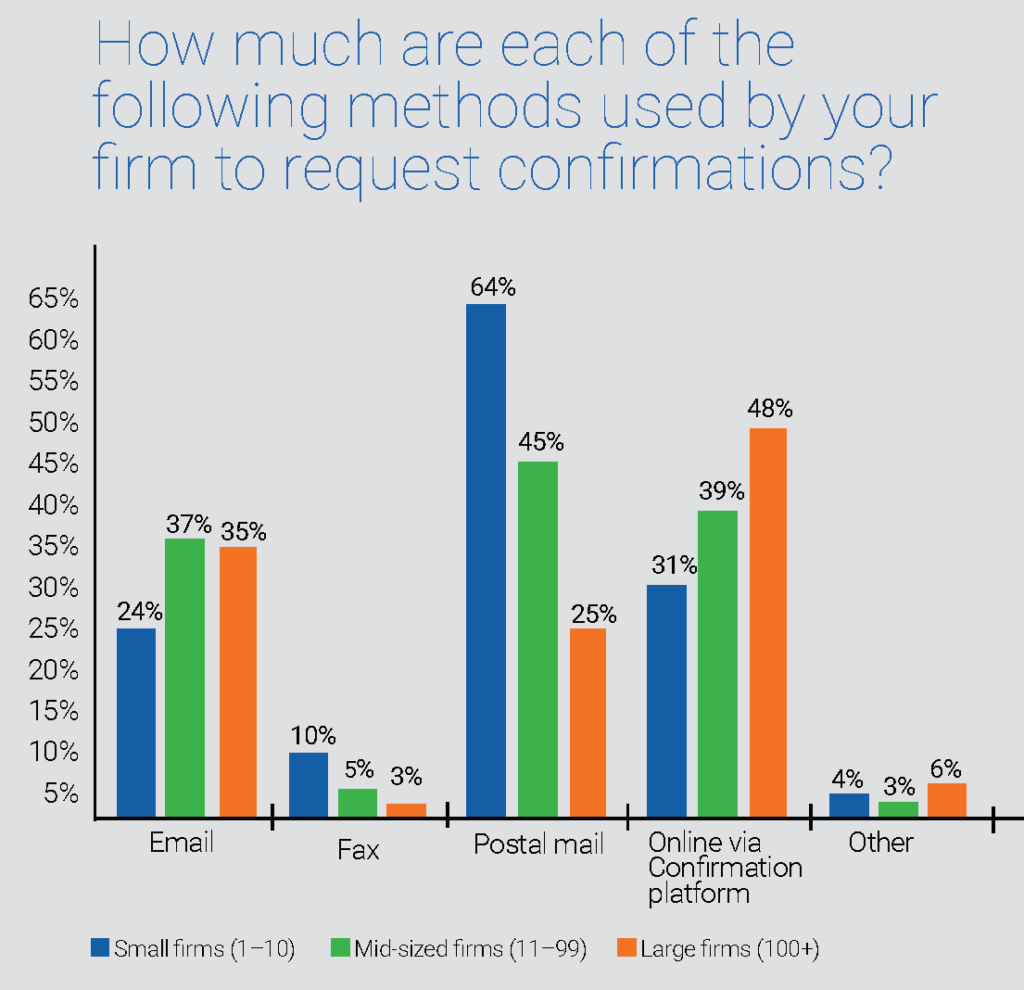

Digital confirmations: Not just for large audit firms anymore

In keeping with traditional technology adoption trends, larger audit firms have been the first to widely adopt digital-led approaches to the confirmation process. Typically, larger firms have the capacity to experiment and willingness to adopt such new approaches, while smaller players tend to take a wait-and-see approach in order to mitigate perceived risks. So where are smaller firms on the adoption curve today - and where should they be given digital advances in the confirmation process? It seems clear from survey respondents that small- and mid-size firms are already making the move to adopt a digital-led approach. At the same time, they still rely heavily on traditional confirmation tools, such as postal mail. In fact, small firms use postal mail more than twice as much as digital approaches. There is a clear trend at work here - the larger the firm, the more likely they are to go digital. There are a range of factors at work behind this trend. Smaller firms are looking to large, early-adopter firms as bellwethers for their own experiences and are looking for positive signs of successful adoption from others before making their own moves. Scale is also an issue. While leaders at smaller firms may recognize the potential value of digital tools, they may think they do not have the resources to change a longstanding practice. But that is quickly changing, as these survey results show. The value equation for small- and mid-sized firms is shifting.

Kim Thomason, a Nashville-based sole practitioner who managed the auditing process at a large accounting firm before setting up her own practice, was surprised to find that even the large firm that previously handled one of her accounts relied on a paper-based process. "I was blown away by the fact that the previous firm had been using paper-based confirmations," Thomason says. With the greater time savings, workflow efficiency, and security an online platform offers, I cannot imagine why any firm wouldn't want to make that transition."

The value imperative

As auditors seek to further increase efficiency, turning to new and emerging technologies to achieve their goals, the confirmation process is a prime target of their efforts. There is a clear trend toward greater adoption of digital confirmations, and we have little reason to suspect that this trend will abate, especially given the levels at which small- and mid-sized firms rely on older, more manual confirmation methods such as postal mail and email.

As auditors expand their adoption of platforms such as Confirmation, they should expect to benefit from greater efficiency in the cumbersome audit process. But this benefit introduces a new imperative: As they benefit from greater efficiency, auditors must find ways to redirect their efforts from routine manual tasks into more strategic efforts that create more value for their audit customers. That's the value imperative for auditors, and it arrives at a critical moment for the profession, as clients begin to expect more from the time and financial resources they invest in the audit. Will auditors rise to the challenge?

Will they do it in time to gain an advantage over their competitors? The stakes are high, not only for individual firms but for the health of the world economy and its financial systems at a time when businesses are moving and changing faster than ever. It's time for auditors to lead the way.

What Confirmation can do for you

Technology is at the core of a well-run audit practice, where a digital tool like Confirmation fuels productivity across teams and departments. In the complex world of auditing, advanced technology helps avoid bottlenecks and process inconsistencies, and moves work seamlessly and efficiently through a firm.

An advanced technology infrastructure positively influences internal workflow and culture. By staying ahead of the technology curve, your firm can also provide a top experience for all of your clients … one that they will want to return to year after year.

Want to hear more? Contact us today.